Studi Kasus: Aksesbilitas Petani Kopi terhadap Kredit dari Lembaga Keuangan Bank

DOI:

https://doi.org/10.25181/jaip.v6i2.954Abstract

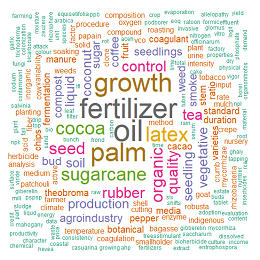

The development of coffee plants in Indonesia shows a rapid growth to fulfill domestic and foreign needs. However, there are still farmers who have not been able to maximize their market potential by using post-harvest technology to increase value added caused by the low accessibility of farmers to farming capital.This research aims to identify accessibility of coffee farmers to financial institution and analyze the factors of credit accessibility towards bank as financial institution of coffee farmers at Kubangsari 2 Farmers Group. The research design used quantitative design with survey research technique. The research sampling used simple random sampling with 31 sample of farmers picked. The data analysis used logit regression method with SPSS 21as a statistical tools. The results show that the coffee farmers take credit accessibility to bank (41,94%), non-bank (3,23%), and non-formal financial institution (51,61%). Besides that, there is 3,23% respondents did not access credit. The result of logit regression shows the factors that effect to credit accessibility of coffee farmers is age, formal education, farming experience, number of coffee trees, and coffee farming income.  Keywords: credit accesibility, farming income, logit regressionDownloads

References

Agresti, A. (2007). An Introduction to Categorical Data Analysis. New York: John Wiley & Sons, Inc. USA.

Direktorat Jenderal Perkebunan. (2016). Statistik Perkebunan Indonesia Komoditas Kopi 2015-2017. Jakarta: Sekretariat Direktorat Jenderal Perkebunan.

Iski, N., Kusnadi, N., & Harianto, H. (2016). Pengaruh Kredit terhadap Pendapatan Petani Kopi Arabika di Kabupaten Aceh Tengah Provinsi Aceh. Jurnal Manajemen & Agribisnis, 13(2), 132-144.

Kirana, S. & Karyani, T. (2017). Perbandingan analisis nilai tambah petani dan petani pengolah pada rantai pasok koperasi produsen kopi Margamulya. Jurnal AGRISEP, 16(2), 165-176.

Nurhapsari, M. S. (2016). Analisis Kendala Kredit dan Pengaruhnya terhadap Produksi Pertanian di Jawa Barat. Unpublished undergraduate thesis, Institut Pertanian Bogor, Bogor.

Putri, I. C. K. (2013). Analisis Pendapatan Petani Kakao di Kabupaten Parigi–Moutong. Jurnal EMBA: Jurnal Riset Ekonomi, Manajemen, Bisnis dan Akuntansi, 1(4), 2195-2205.

Rahayu, L. (2016). Aksesibilitas petani bawang merah terhadap lembaga keuangan mikro sebagai sumber pembiayaan. AGRARIS: Journal of Agribusiness and Rural Development Research, 1(1), 52-60.

Rahman, S., Hussain, A., & Taqi, M. (2014). Impact of agricultural credit on agricultural productivity in Pakistan: An empirical analysis. International Journal of Advanced Research in Management and Social Sciences, 3(4), 125-139.

Sebopetji, T. O., & Belete, A. (2009). An application of probit analysis to factors affecting small-scale farmers decision to take credit: A case study of the Greater Letaba Local Municipality in South Africa. African Journal of Agricultural Research, 4(8), 718-723.

Sekyi, S., Abu, B. M., & Nkegbe, P. K. (2017). Farm credit access, credit constraint and productivity in Ghana: Empirical evidence from Northern Savannah ecological zone. Agricultural Finance Review, 77(4), 446-462.

Wati, D. R. (2015). Akses dan Dampak Kredit Mikro terhadap Produksi dan Pendapatan Usahatani Padi Organik di Kabupaten Bogor. Unpublished master's thesis. Institut Pertanian Bogor, Bogor.

Downloads

Published

How to Cite

Issue

Section

License

Authors who publish with Jurnal Agro Industri Perkebunan agree to the following terms:

Authors retain copyright and grant the Jurnal Agro Industri Perkebunan right of first publication with the work simultaneously licensed under a Creative Commons Attribution License (CC BY-SA 4.0) that allows others to share (copy and redistribute the material in any medium or format) and adapt (remix, transform, and build upon the material for any purpose, even commercially) with an acknowledgment of the work's authorship and initial publication in Jurnal Agro Industri Perkebunan.

Authors are able to enter into separate, additional contractual arrangements for the non-exclusive distribution of the journal's published version of the work (e.g., post it to an institutional repository or publish it in a book), with an acknowledgment of its initial publication in Jurnal Agro Industri Perkebunan. Authors are permitted and encouraged to post their work online (e.g., in institutional repositories or on their website) prior to and during the submission process, as it can lead to productive exchanges, as well as earlier and greater citation of published work.